Investment Management for Individuals and Institutions Since 1988

What Makes Investment Management Different with Eastover Capital?

As a fee only, fiduciary, independent firm manager, we do not collect trading commissions, allowing transparent pricing, while minimizing cost, turnover, and taxes whenever possible. With a customized approach to investment management, we invest the time to learn each client’s unique circumstances ensuring our client’s investments align with their values. We are regulated by the SEC (U.S. Securities and Exchange Commission).

Talk to an Advisor

509 Fenton Place Charlotte, NC 28207

Eastover Capital Through The Years

1988

Employee Owned Firm is Founded

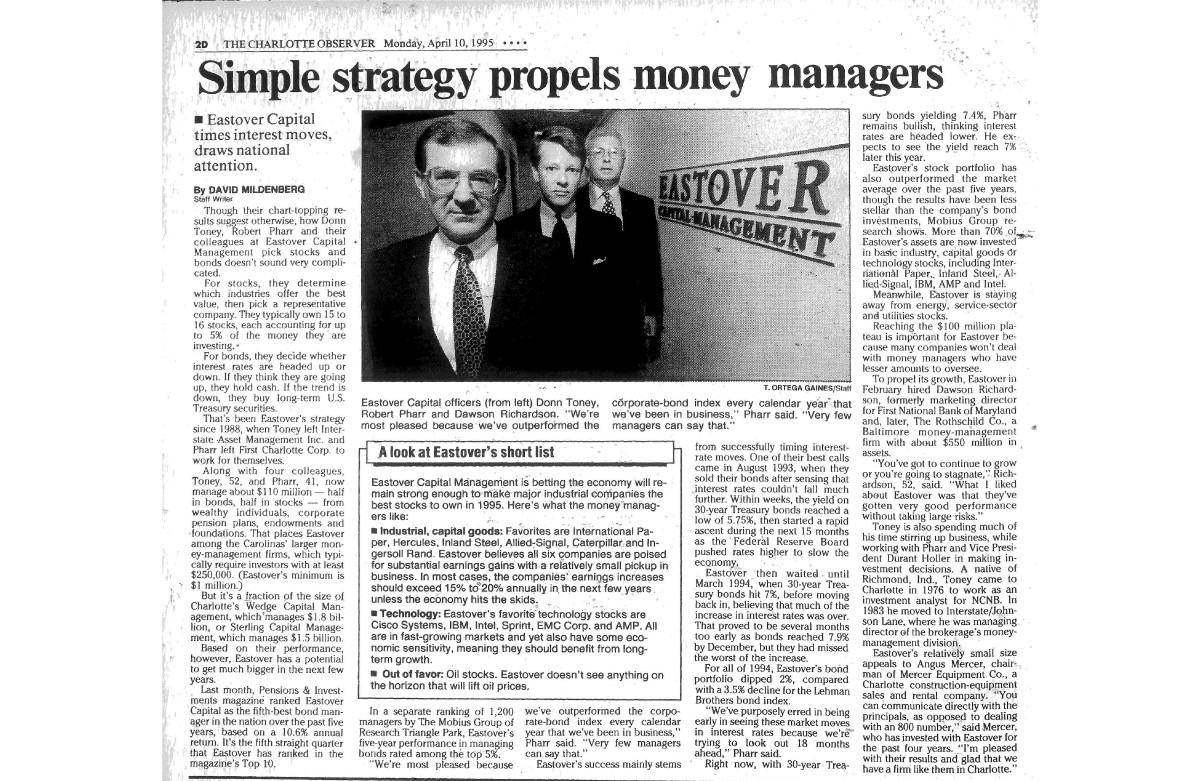

Eastover Capital was founded in 1988 by Donn Toney and Robert Pharr as one of the first fee-only investment firms in the Charlotte, NC area.

2005

Ownership Change

A group of 10 community banks purchases Eastover Capital in an effort to make available its investment management expertise to their bank clients.

2011

New President & CEO

Will Mackey is hired by the Board of Directors to serve as President & CEO.

2015

Ownership Change

Will Mackey acquires sole ownership of the firm, bringing Eastover Capital back to its roots as an Owner Operated firm.

2018

New Office Space

Historic 100-year-old home was purchased in the Eastover neighborhood of Charlotte, to serve as office space.

230

Households

12

Institutional

Clients

120+

Years of Industry

Experience

Frequently Asked Questions

With a customized approach to investment management, Eastover Capital invests the time to learn each client’s unique circumstances — from tax sensitivity to socially responsible investing to charitable objectives – ensuring your investments align with your values, while fully understanding our process and what you own.

Where will my money be held?

Eastover Capital has selected Charles Schwab to serve as its custodian. While we make all investment decisions for our clients, Schwab is responsible for maintaining all client assets and holdings.

Who makes the investment decisions at Eastover?

As an independent SEC-registered Investment Advisor, Eastover Capital makes the investment decisions based on each client’s individual circumstances. Our in-house Investment Policy Committee is responsible for selecting individual stocks and bonds to build portfolios.

What reporting will I receive on my accounts?

Clients receive quarterly statements from our custodian, Charles Schwab. Eastover provides additional, more detailed reporting during individual client reviews.

How will I pay for Eastover Capital's services?

Eastover is a fee-only investment advisor and does not collect trading commissions. Our fees, billed quarterly, are based on the value of the investments we manage for each individual client relationship.

How often would I meet with my advisor?

As a relationship focused firm, the best part of any day is the time we spend meeting with our clients and their families. We meet regularly based on a mutually agreed upon schedule and as changes to financial circumstances warrant.